Learn how a leading Singaporean bank faced with fragmented data and slow processing, leveraged AWS cloud solutions to streamline data management. This strategic initiative reduced processing times and enhanced decision-making, achieving a 30% rise in customer engagement.

Client Overview

A prominent Singapore-based bank, renowned for its innovative approach and dedication to sustainable finance. With operations across multiple international markets, the bank provides a spectrum of services including personal banking and complex capital market transactions.

Business Challenge

The bank faced significant challenges in managing and processing large volumes of data from multiple sources, impacting decision-making and risk analysis. The primary issues included:

- Data Fragmentation: Difficulties in consolidating data from over 10 different sources

- Slow Processing Speeds: Existing systems took nearly a week to process critical data, delaying key financial decisions

- Regulatory Compliance: High stakes in meeting international compliance demands for data security and privacy

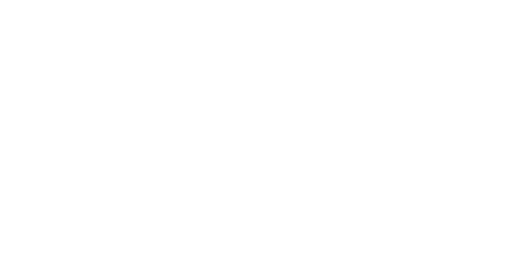

Challenges

- Data Security

- Regulatory adherence

- Secure data transfers

- Data Processing

- Acceleration of data analytics

- Integration of disparate data sources

- Business Intelligence

- Development of scalable visual tools

- Implementation of real-time reporting

Implementation Plan

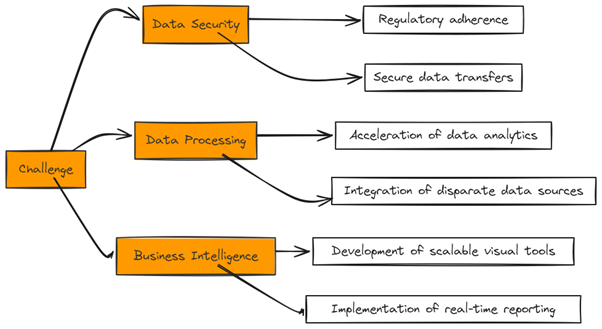

- Phase 1 – Planning and Design: Workshops with key stakeholders to outline specific requirements and establish project timelines.

- Phase 2 – Infrastructure Setup: Configuration of AWS S3, Glue, RDS, and Lake Formation to create a secure and scalable data environment.

- Phase 3 – Data Pipeline Development: Developing and testing data ingestion and transformation pipelines in AWS Glue.

- Phase 4 – Deployment and Testing: Rolling out the solution in stages, followed by comprehensive testing for performance and security.

- Phase 5 – User Training and Go-Live: Training sessions for end-users on navigating the new system, particularly AWS Quicksight for data analytics.

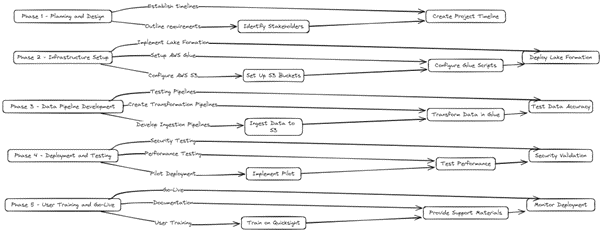

CloudJournee Solution

Our team deployed a sophisticated data architecture utilizing AWS technologies to centralize and secure the bank’s data. By leveraging AWS Glue for data pipelines and AWS Redshift for storage, we ensured that transformed data is readily available and securely stored. AWS Quicksight offers advanced visualization tools, enabling stakeholders to derive actionable insights swiftly.

Benefits and Key Values Realized

- Enhanced Data Security: Met all international data security standards, significantly reducing the risk of data breaches.

- Operational Efficiency: Processing time reduced from 6 days to 5 hours, enhancing responsiveness to market changes.

- Strategic Decision Making: High-quality, real-time data at decision-makers’ fingertips, supporting more informed and quicker decision-making.

- Customer Engagement: Improved insights into customer behaviors and needs, leading to a 30% increase in customer engagement and satisfaction.

Customer Testimonial

“The transformation has been phenomenal. With the new system in place, not only have our operations become more efficient, but our ability to make data-driven decisions quickly has greatly enhanced our competitive edge. We’re seeing results that surpassed our expectations,” – CTO.

Realized Customer Value

- Reduction in data processing time by 90%.

- Compliance with 100% of applicable data security regulations.

- Increase in operational efficiency, contributing to a 30% growth in business operations.